Believe it or not, the world is moving towards a cashless society. From debit cards to QR codes, mobile banking apps, and digital payment solutions, to cryptocurrencies, the world seems to be bent on eliminating cash.

The ongoing COVID-19 pandemic has increased interest in contactless payments manyfold. It is not by chance that 2021 was a year of major breakthroughs in the adoption of cryptocurrencies. Digital payment solutions are on the rise. Considering that the world is closing to 5 billion people with access to the internet, it is obvious that financial accessibility is changing fast.

How a cashless society affects cryptocurrency accounts

| Ranking for individual weighted metrics feeding into Global Crypto Adoption Index | |||||

|---|---|---|---|---|---|

| Country | Index score | Overall index rankin | On-chain value received | On-chain retail value received | P2P exchange trade volume |

| Vietnam | 1.00 | 1 | 4 | 2 | 3 |

| India | 0.37 | 2 | 2 | 3 | 72 |

| Pakistan | 0.36 | 3 | 11 | 12 | 8 |

| Ukraine | 0.29 | 4 | 6 | 5 | 40 |

| Kenya | 0.28 | 5 | 41 | 28 | 1 |

| Nigeria | 0.26 | 6 | 15 | 10 | 18 |

| Venezuela | 0.25 | 7 | 29 | 22 | 6 |

| United States | 0.22 | 8 | 3 | 4 | 109 |

| Togo | 0.19 | 9 | 47 | 42 | 2 |

| Colombia | 0.19 | 11 | 27 | 23 | 12 |

| Argentina | 0.19 | 10 | 14 | 17 | 33 |

| Thailand | 0.17 | 12 | 7 | 11 | 76 |

| Philippines | 0.16 | 15 | 10 | 9 | 80 |

| Brazil | 0.16 | 14 | 5 | 7 | 113 |

| China | 0.16 | 13 | 1 | 1 | 155 |

| Ghana | 0.14 | 17 | 32 | 37 | 10 |

| South Africa | 0.14 | 16 | 18 | 16 | 62 |

| Russian Federation | 0.14 | 18 | 8 | 6 | 12 2 |

| Tanzania | 0.13 | 19 | 60 | 45 | 4 |

| Afghanistan | 0.13 | 20 | 53 | 38 | 7 |

The 2021 Chainalysis Global Crypto Adoption Index report places emergent markets as the bigger adopters of cryptocurrencies. Vietnam, India, Pakistan, Kenya, Nigeria, Venezuela are among the top countries by huge transaction volumes on peer-to-peer platforms.

With the global crisis, the gap between the rich and the poor is widening. There is an absence of inclusive financial infrastructure. Emergent markets face currency devaluation and the flow of payments through remittance is significant.

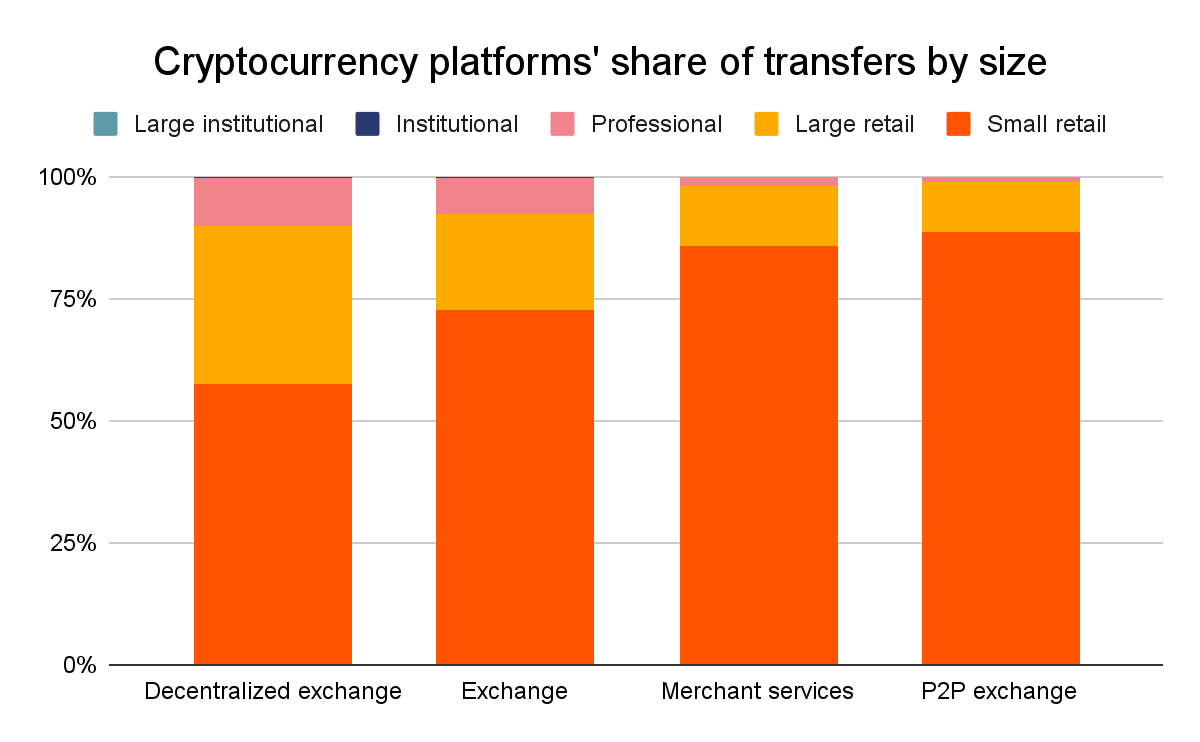

This is where cryptocurrencies shine offering faster, cheaper, and safer solutions for personal and commercial transactions carried out by merchants in emerging markets. While most P2P (peer-to-peer) platforms carry huge volumes of exchange trade, it is made up of small, retail-sized payments under $10.000 worth of cryptocurrency.

Basically the poor and the unbanked left out of the inefficient, slow, and expensive procedures of central banks are now granted entrance to reliable, fast, and cheap banking solutions, as long as they can have access to a mobile phone and a network.

Cryptocurrency

Typical cryptocurrencies, like bitcoin, are decentralized. Since no one “owns” the bitcoin, it can act as a superb peer-to-peer borderless financial system. The speed and lack of intermediaries create an amazing tool for financial transactions, as it allows quick and cheap transfers. This especially benefits those who need to send money to families overseas, or to those who are denied access to the traditional centralized banking system, either because their country lacks an efficient financial system, or because they are poor and unbanked. Volatility makes bitcoin and similar currencies impractical for day-to-day use, e.g. shopping for groceries but creates a practical and easy-to-use payment system.

Stablecoins

Speaking of groceries, stablecoins are able to solve that problem of volatility that cryptocurrencies like bitcoin face. Stablecoins are pegged to an asset, such as gold or US dollar, but are not issued by a central bank. They can be both decentralized (e.g. belonging to a community) or centralized (e.g controlled by an issuing organization, currently a crypto-company for example).

The value of stablecoin is fixed. For example, Tether (USDT) is a stablecoin pegged to a value of US dollar, always equal to $1 with tiny fluctuations within a few pennies worth. Even in the world of crypto-trading, stablecoin are very valued as a medium of exchange. They could make it easy to join cheaper, faster, and decentralized financial infrastructures of blockchain easily accessible to small businesses, and individuals, especially because stablecoins take the volatility out of the equation.

Central bank digital currencies (CBDC)

The central bank issues money. Be it a dollar, euro, yuan, or pound, it is the central bank that issues coins and banknotes, declaring their worth. Such currency is called ‘fiat’ as it is not backed by gold or other commodities, but by the promise of the government’s stability. With fiat-currency citizen needs to trust the government that the amount of money in circulation is backed by the economic power of the country, that government will not print or create more money. When the government fails to regulate money properly, we get hyperinflations, and financial meltdown (like the mortgage crisis of 2007).

CBDC is a virtual form of fiat currency. It is a digital token of a country’s official currency. It’s something like an ‘official’ stablecoin. The idea is to have the flexibility and simplified infrastructure of a cryptocurrency together with centralized control of fiat currency. Because it is easier to provide infrastructure for CBDC than it is for traditional banking, it is seen as a more inclusive and potential solution for the ‘unbanked’ population of developing countries.

Towards the cashless society

Cryptocurrency is not the only vehicle for the arrival of the cashless society but probably is the MVP. It addresses many disadvantages and concerns surrounding a cashless society.

Money laundering is primarily done with cash. Contrary to the initial media crypto-scare, only 0.5-2% of all the cryptocurrency transfers belong to criminal activity. Moreover, illegal transactions, like the purchase of narcotics or weapons, more often happen with cash. Digital transactions, especially those made on blockchain always leave a trail. Handling money, printing it, storing it, and transferring large amounts of cash costs a lot. Cryptocurrency alleviates those costs.

Cashless payments through cryptocurrency eliminate the need for local fiat currency exchange, making all international payments way cheaper. While cash is impossible to hack, the way cryptocurrency is stored makes digital money less prone to hacker attacks. Traditional banking, even in the cashless society can be unfair to the poor and unbanked, but the availability of cryptocurrency through simple mobile apps brings inclusive financial infrastructure to the masses.

Is the cashless society going to be a utopia? Probably not. Cash has its benefits. The collapse of infrastructure leaves all kinds of digital finances inaccessible, while cash is – cash, you can use it even if the power is out, or the internet is down. Cash is free. Digital payments always come with a fee. Certain retailers offer discounts for cash payments. Carrying cash leaves you prone to pickpocketing or mugging, but no one can pull off a sophisticated fraud crime on the cash in your pocket. Cash is private. Cryptocurrency also offers superb privacy. However, due to government regulations, especially the KYC (know your customer) set of laws and the introduction of CBDCs, digital money is losing privacy fast.

Like it or not, the cashless society is approaching. Will the cash die out or survive is anyone’s guess but with each step towards wider adoption of cryptocurrencies, we can hope that it will continue to bring cheaper, safer, and more inclusive financial services for all.

Just an open-minded guy, seizing new opportunities in life as well as in his career. Investing and following the ups and downs of bitcoin. Writing is my favorite hobby.